Home Insurance

The Harvest Agency

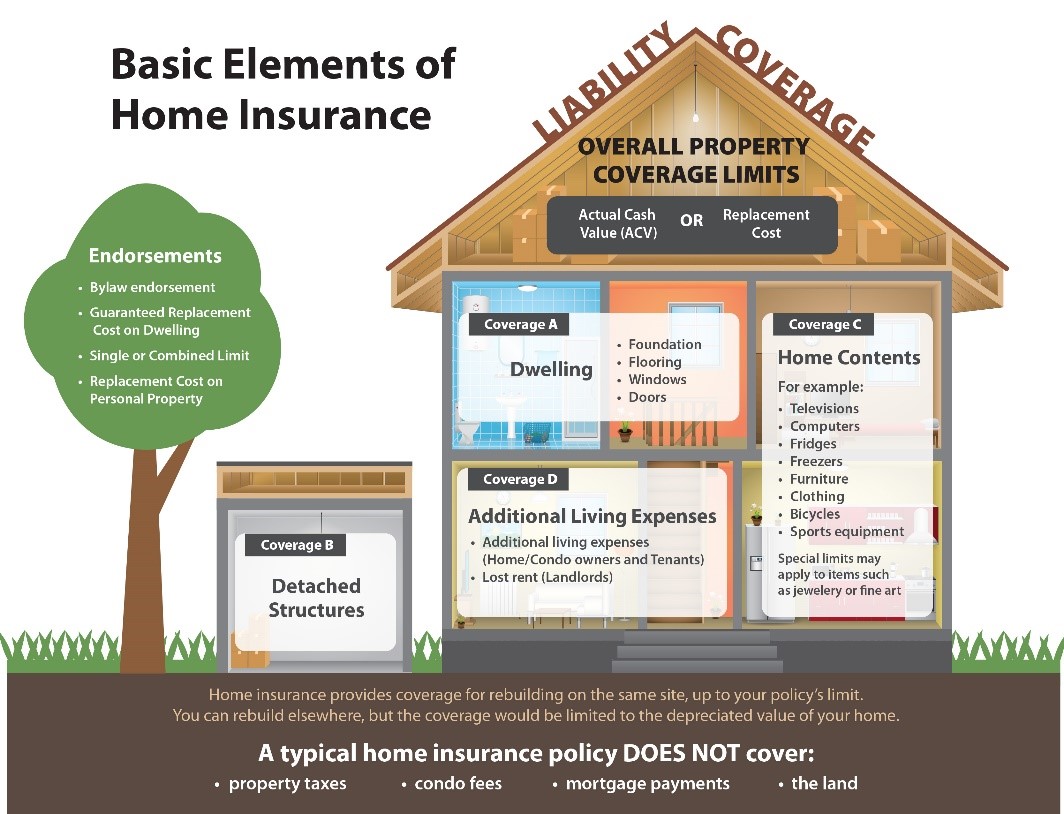

Homes values are determined by either:

1. Actual Cash Value (ACV)

Defined as the cost to replace something with like kind or quality, AFTER DEDUCTING depreciation.

2. Replacement Cost

Defined as the cost to replace something with like kind or quality, WITHOUT DEDUCTING depreciation.

What is Home Insurance?

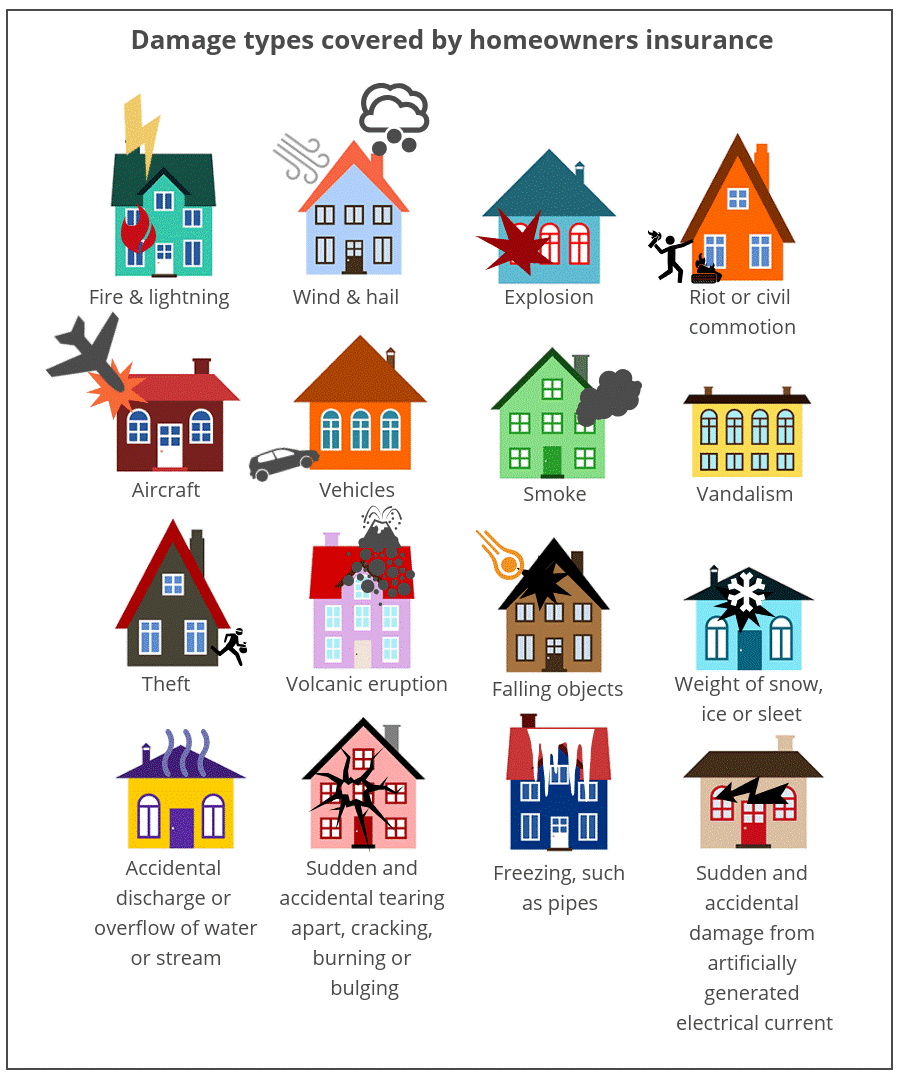

Home insurance, also commonly called hazard insurance or homeowner’s insurance, is a type of property insurance that covers a private residence.

It is an insurance policy that combines various personal insurance protections, which can include losses occurring to one’s home, its contents, loss of use (additional living expenses), or loss of other personal possessions of the homeowner, as well as liability insurance for accidents that may happen at the home or at the hands of the homeowner within the policy territory.

- As your largest investment, it's important to make sure your home has the proper insurance coverage. We'll protect your home and everything in it for the lowest possible price.

Instant Insurance Quote

In a hurry? Get a quote on your

insurance policy instantly.

A primary home is a person’s main and permanent residence, where they live and spend the majority of their time.

A seasonal home is a property primarily used for vacations or recreational purposes, typically located in a desirable location and used during specific seasons or times of the year.

A multi-family home is a residential property that is designed to accommodate multiple separate living units, such as apartments or condominiums, within a single building or structure.

A landlord dwelling home is a property owned by an individual or entity and rented out to tenants for residential purposes, typically managed by the landlord or a property management company.

Builder’s risk insurance is a type of coverage that protects a construction project or structure from damages and losses that may occur during the course of construction or renovation. **For more details see “Business” and “Real Estate” under “Specialized Industries”.

Renters insurance is a type of insurance policy that provides coverage for personal belongings and liability protection for individuals who are renting a home or apartment.

Ready To Protect Your Lifestyle?

We provide the coverage and protection you need so you can focus on what matters most.