Auto Insurance

The Harvest Agency

I WANT FULL COVERAGE

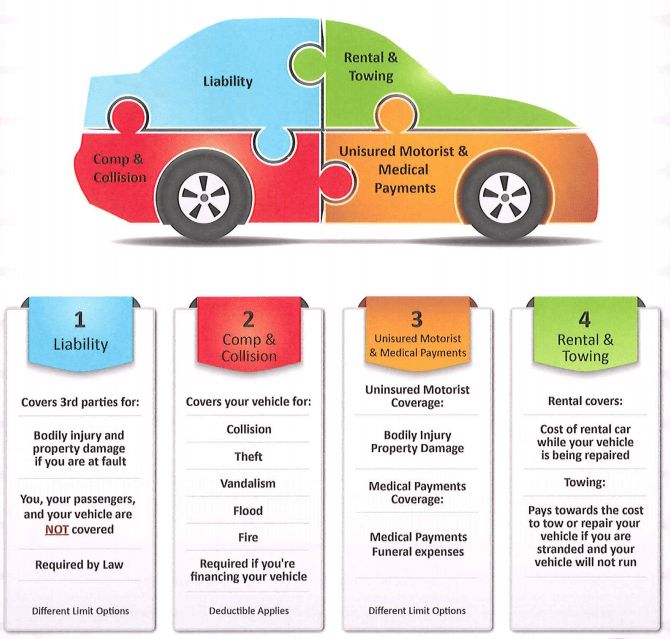

“Full coverage” is a term commonly used by lenders to refer to a combination of comprehensive and collision coverage on an auto insurance policy.

However, at The Harvest Agency, we do not use the term “full coverage” because it can be misleading.

Auto insurance coverage is not a one-size-fits-all solution and the specific coverage needed can vary depending on factors such as the value of the vehicle, individual preferences, and state requirements. We believe in tailoring coverage to meet the specific needs of our clients and ensuring they have adequate protection in place. This may include additional coverage options beyond comprehensive and collision, such as liability, uninsured/underinsured motorist, medical payments, and more. By working closely with our clients, we help them understand their options and make informed decisions about their auto insurance coverage.

With over 15 carriers in our portfolio, we are sure to get you a great rate without the hassle of having to solicit quotes from several insurers. We save you all that time comparing different policies’ coverages, deductible amounts, and limits with the benefit of having a highly qualified agent by your side the entire time answering any questions along the way.

Instant Insurance Quote

In a hurry? Get a quote on your

insurance policy instantly.

Your classic car needs great coverage from an insurance agency that loves cars as much as you do. It only takes a few minutes to find out how much money you can save!

What is Classic Auto Insurance?

Classic Car insurance is very similar to regular car insurance, but is often less expensive because the vehicles being insured are not used for every day driving.

There are a number of factors that qualify vehicles for Classic Auto Insurance, including the model year, annual miles driven, and customizations.

- Typical Vehicles That Qualify for Classic Car Insurance

- Antique & Classic Cars

- Modern Collector Vehicles

- Modified Vehicles

- Classic Trucks & Utility Vehicles

- Motorsports Vehicles

- Antique Tractors

- Vintage Motorcycles & Scooters

- Retired Commercial Vehicles

- Collector Trailers

- Vehicles Under Construction

- Classic Military Vehicles

**Important —Please note completion of any request(s) for information does not constitute the purchase of insurance. No coverage may be added, changed or bound as a result of submitting a request for information or quotation of insurance. All coverage must be confirmed by the agency in writing subject to an acceptable signed application meeting the underwriting guidelines of the Insurance Company.

Recreational vehicles (RVs) are motorized, or towable vehicles designed for recreational use. They are essentially mobile homes on wheels, providing both transportation and living accommodations. RVs are popular among travelers who enjoy the freedom and flexibility of exploring different destinations while having the comfort and convenience of a home.

- There are several types of recreational vehicles, including:

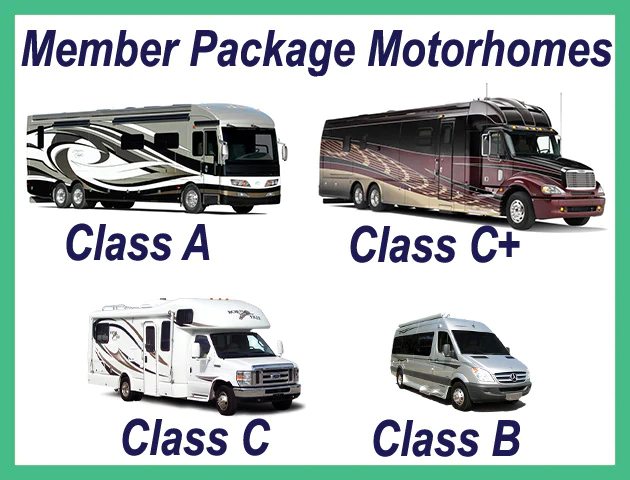

1. Motorhomes

These are self-contained units that combine both the living quarters and the vehicle chassis. Motorhomes come in three main classes:

- Class A- The largest and most luxurious motorhomes, often resembling buses. They offer spacious interiors with various amenities and are suitable for long-term travel.

- Class B- Also known as camper vans, these are smaller and more maneuverable compared to Class A motorhomes. They typically feature a raised roof for additional headroom and basic amenities.

- Class C- These motorhomes are built on a truck or van chassis and have a distinctive over-cab sleeping area. They provide a balance between size, amenities, and cost.

2. Travel Trailers

These RVs are towed by a separate vehicle, such as a truck or SUV. Travel trailers come in various sizes and layouts, ranging from compact trailers with basic amenities to larger models with multiple rooms, full kitchens, and bathrooms.

3. Fifth Wheels

Similar to travel trailers, fifth wheels are towed by a pickup truck with a specialized hitch in the truck bed. They typically have a bi-level design, with a raised front section that extends over the truck bed, providing additional living space.

4. Pop-up Campers

Also known as tent trailers or folding campers, pop-up campers are lightweight and compact when folded down for transport. They expand and unfold at the campsite to provide sleeping areas, basic amenities, and sometimes additional living space.

RVs offer various amenities, depending on their size and class, including sleeping areas, kitchens, bathrooms, dining areas, entertainment systems, air conditioning, heating, and storage space. They provide a flexible and comfortable way to travel and enjoy outdoor adventures while having the comforts of home.

Ready To Protect Your Lifestyle?

We provide the coverage and protection you need so you can focus on what matters most.