Life Insurance

The Harvest Agency

“Protect Your Loved Ones’ Future with Life Insurance”

Life insurance is a contract between a policyholder and an insurance company, where the policyholder pays premiums in exchange for a death benefit paid out to their beneficiaries upon their death. Life insurance provides financial security to the policyholder’s loved ones in the event of their untimely death.

The Most Common Types of Life Insurance Are:

- 1. Term life insurance

Provides coverage for a specific period of time (term), usually 10 to 30 years. Pays a death benefit to the beneficiaries if the policyholder passes away during the term.

- 2. Whole life insurance

Provides permanent coverage for the policyholder’s entire life. Pays a death benefit to the beneficiaries and includes a savings component, known as cash value, which grows over time.

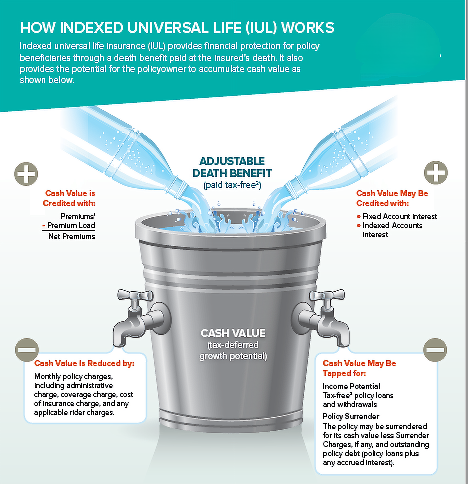

- 3. Universal life insurance

Provides permanent coverage with flexible premiums and death benefits. Includes a savings component that earns interest, which can be used to pay premiums or increase the policy’s cash value.

- 4. Indexed universal life insurance

Similar to universal life insurance, but the policy’s cash value is tied to an equity index, such as the S&P 500, allowing for potential higher returns.

The Harvest Agency specialize in maximizing wealth for six-figure earners through tax reduction and dividend strategies.

- Did You Know?

Life insurance offers benefits both in life and after. Ask Me How?

Schedule A Consultation

- There are several life insurance strategies that can help individuals and families achieve their financial goals and protect their loved ones. Some common strategies include:

- Final Expense

Is a type of life insurance that covers the policyholder’s end-of-life expenses, such as funeral costs, medical bills, and other outstanding debts. It provides a lump-sum payment to the beneficiary to cover these expenses and may have lower coverage limits than other life insurance policies. Typically for ages 50+.

- Pre-Need Burial

Is a type of life insurance that specifically covers funeral expenses. The policy pays a lump-sum to the beneficiary (typically a funeral home) to cover the costs associated with the policyholder’s burial or cremation, such as funeral home services, caskets, urn, and other related expenses.

- Mortgage Protection

Is a type of life insurance that pays off the remaining mortgage balance if the policyholder passes away. It provides financial security for the beneficiary and ensures that the mortgage is paid off, preventing the loss of the home due to unpaid debts.

- Loan Protection

Is a type of insurance that covers loan payments in case the borrower becomes unable to make payments due to a covered event, such as job loss or disability. It provides financial protection and ensures that the borrower does not default on the loan.

- Income Replacement

Provides financial support to the beneficiaries in the event of the policyholder’s death. The policy pays out a lump sum, usually tax-free, to replace the lost income and cover expenses such as mortgage payments, education costs, and other bills.

- College Education Planning

Is a process of using insurance products, such as life insurance or annuities, to save and invest for future education expenses. It provides financial security for families by ensuring that the funds will be available when needed for tuition, room and board, books, and other education-related expenses. It can also offer tax advantages and flexible payment options to help meet savings goals.

- Estate Planning

involves purchasing life insurance to provide liquidity for estate taxes, debts, and other expenses after the policyholder’s death. It allows the policyholder to plan for the distribution of their assets and ensures that their family is not burdened with financial obligations. It can also provide a source of income for the family and minimize the tax liability on the estate.

- Key-Employee

Is a policy purchased by a business that helps businesses mitigate the financial loss associated with the death of a key employee. The policy pays a death benefit to the company, which can be used to cover expenses such as recruiting and training a replacement, paying off business debt, or funding a buy-sell agreement. It also helps maintain business continuity and stability.

- Buy-Sell Agreement

Is a type of life insurance that helps businesses fund a buyout of a partner or shareholder’s interest in the event of their death or disability. The policy pays out a death benefit to the surviving partner or shareholder, who can use the funds to buy the deceased or disabled partner’s shares. It helps ensure business continuity and protects the interests of the surviving partners or shareholders.

- Deferred Compensation

Is an agreement between an employer and an employee to defer a portion of the employee’s salary until a later date, usually retirement. The deferred amount is invested and protected by an insurance company, allowing the employee to receive a fixed income in the future.

Protect Your Lifestyle

We provide the coverage and protection you need so you can focus on what matters most.